Article originally published in Forbes

As the startup market has matured over the years, so too have the models for company acceleration and growth. New industries have unfolded to nurture seedling companies and develop them from conception through to launch and eventual exit. These models include accelerators, incubators, VCs, angels, and now the startup studio model is unfolding as a new approach to accelerating innovation.

Accelerators for startups come in all flavors from broad-stroke cohorts such as Techstars or 500 Startups to more niche accelerators focusing on specific verticals such as IndieBio. After a competitive application process, accelerators will select a cohort of startup teams (ranging from 10-20). Those selected will be put through “boot camp for startups”, a rigorous 6-12 week program that teaches founders how to find product-market fit, develop marketing strategies, build investor decks and pitch their companies. In exchange for a small percentage of equity ranging from 3-12% and a possible small investment, accelerators prepare the teams for a seed investment from a VC. The program culminates with a demo day after which the startups are then set free to spread their wings and fly on their own.

Incubators are similar to accelerators in that they provide space and shared resources to startups, but usually not any capital. Their financial models are based on membership fees that grant access to a shared coworking space, resources and access to other founders and operational expertise.

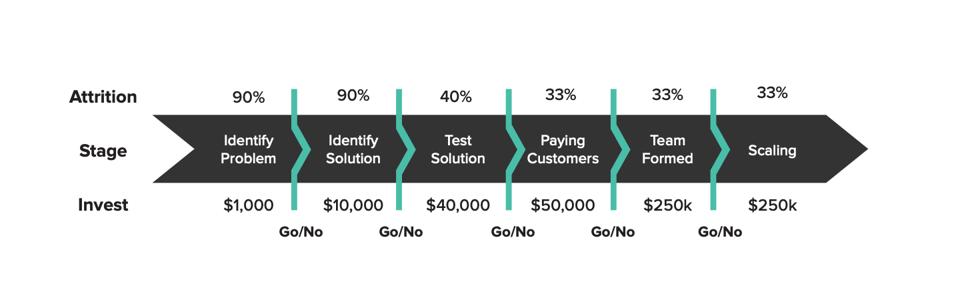

Studios, unlike incubators or accelerators, are specialists in idea generation. Studios can either start with an idea or a team first, they then set forth on a path to validate the idea and determine whether to take it to market by passing through a series of “stage gates” that will give a “Go / No Go” decision based on key metrics and milestones. Studios, unlike accelerators, will take quite a large stake in companies, up to 45% and do not operate on a set timeframe but rather stick with hitting each of the stage gates until product-market fit is found and where passing the last stage-gate indicates a “go to market”.

Studios are not new, in fact, Bill Gross’ IdeaLab is one of the first and most successful, preceding the rise of accelerators. It has been testing ideas and spinning successful ones off into companies since 1996 with over 45 IPOs to date. However, one of the most famous and successful studio exits is Dollar Shave Club which was hatched out of startup studio, Science and was sold for $1 billion to Unilever. Science, like most start-up studios, takes a hands-on approach to its investments that include mentoring, strategic guidance, and access to operational resources.

The AI Play in Startup Studios

While each of these players in the innovation landscape brings a unique approach, thesis, and methodology to support start-up growth, the field of AI, in particular, is well-positioned to benefit from the studio model. Because of their structure and gated mechanisms, startup studios may take longer to bring a product to market, but along the way have de-risked much of the standard startup founding process. Their advantages include:

- Inception starts with previously successful and experienced entrepreneurs.

- Stage-gate methodology removes emotion from the equation through objective data-driven evaluation.

- A higher cost of ownership through deeper engagement from investment partners who have more skin in the game as builders vs. just funders.

- A methodological process that works for more complicated ideas and larger bets.

As a growing field, the demand for AI expertise and associated technologies has also caught fire. An AI Studio, such as Verdant AI is poised to capitalize on this trend. Brian Dolan, Verdant’s CEO and Founder is well-known in the data community as a leading mathematician, data scientist, founder, and analyst with more than 20 years of hands-on experience.

“Building AI products is an extremely complicated endeavor that requires highly skilled expertise,” explains Dolan.

“Much like when a band comes together to jam, a studio bringing together multiple AI expert players expands creative solutions as ideas flow from a diverse range of experiences. This setting, like an extended jam session, allows creativity to flourish within a quick failure structure that is best suited for solving complex AI problems.”

The Verdant studio team is stacked with expertise in key technical areas of engineering, application design, analytics, and product-market fit. They work closely together to identify areas of need, with a current focus on health and oceans and then set to work as a team to build AI products that will eventually evolve into companies driving solutions to the world’s biggest issues.

Jake Hurwitz, former VP of Branding at Boulder Bits startup studio, and the Cofounder of the Global Startup Studio Network (GSSN), which was recently acquired by GAN, feels we are entering a new era of frontier technological innovation that is well-tuned to flourish within the studio model. The ability to launch a company has never been easier than today, which has fueled an oversaturation of web-based consumer businesses and mobile apps in the market. However, most of these companies are not capable of tackling the big problems of today simply because of a lack of resources and experience. The studio model, in particular, enables a group of experienced domain experts to collaborate on the world’s biggest problems and get to solutions faster.

“I’m excited about frontier technologies such as AI, but it’s still relatively early for it to impact our lives in a meaningful way. Studios are wonderful vehicles for developing solutions to humanity’s biggest problems, such as climate change or developing advanced biotech breakthroughs that can lead to cures and save millions of lives.”

Unleashing the Value of Opportunity Zones

Startup studios are still in a nascent phase but poised to rise quickly. Clarence Wooten, Founder of Revitalize Ventures is applying the model within the framework of Opportunity Zones, a recently created tax incentivization structure designed to spur development in economically-distressed communities.

These recent tax code changes enable a deferment in capital gains through investment in OZ funds that invest in OZ-based real estate or businesses. After a 10 year commitment, the resulting gains are tax-free. Revitalize Ventures is looking to attract underrepresented founders and operators of color to move their headquarters to West Oakland’s opportunity zone with a focus on SaaS, AI, and marketplace technologies.

”Our goal is to build breakout tech startups that spin-out, grow and support the revitalization of underserved (opportunity zone) communities,” says Wooten.

“Not only will these companies stimulate economic growth and provide job opportunities, but the infusion of professionals representative of the current ethnic demographics of those communities will also generate inspiration for the youth in those communities to pursue innovation and careers in tech.”

Accelerated Innovation Benefits Humanity

Taking a templatized and methodological approach to idea validation supported by collaborative domain expertise means new solutions to humanity’s biggest problems can be brought to market faster. Applying the startup studio model can accelerate our path to innovation on solutions for climate change, economic inequality, ocean degradation, and health epidemics for the benefit of humanity.

AI, in particular, is a force multiplier for nascent companies. Within a studio framework, the foundational components to building an AI startup are readily available. It provides an enormously advantageous head start, with the initial tasks of the development of a data strategy, building primary models, access to highly skilled DevOps along with the expertise of an experienced entrepreneurial team accelerating time to market while minimizing risk.

The rise of the startup studio is a sign of great things to come, especially through innovations in AI and other frontier technology breakthroughs that will change our lives for the better.

Author – Annie Brown